Key Takeaways

- The One Big Beautiful Bill Act (OBBBA), a $1 trillion federal spending and tax package signed into law on July 4, 2025, includes major healthcare provisions alongside broader budget measures.

- The One Big Beautiful Bill includes the Rural Health Transformation Fund, providing $50 billion over five years to support rural hospitals, though unjust fund distribution and competition for rural designations may skew the financial benefit away from the intended hospital recipients.

- Medicaid work requirements could create administrative challenges and potential coverage gaps, particularly in rural communities, impacting patient access and therefore hospital financial stability.

- Rural hospitals face ongoing financial pressures, and Pathstone Partners is uniquely positioned to support rural hospitals in optimizing operations, managing costs, and improving resilience without impacting the quality of care.

Unpacking the OBBBA: How the Law Shapes Healthcare

H.R. 1, the One Big Beautiful Bill Act (OBBBA), a spending and tax law passed through the reconciliation process and signed into law on July 4, 2025, has prompted widespread discussion regarding potential impacts on healthcare programs, with the bill representing an overall $1.4 trillion reduction in federal spending. States are now required to implement health-related provisions, including changes to Medicaid coverage and rural healthcare funding.

The Congressional Budget Office (CBO) anticipates that 11.8 million people will lose health insurance over the next decade as a result of the OBBB, creating serious consequences for community health and straining healthcare providers. Uninsured individuals already face steep challenges: nearly half of uninsured adults go without provider visits, one in five skip needed treatment due to cost (vs 5-7% of insured adults), receive less preventative care, and are consequently more often hospitalized for avoidable conditions. These projected coverage losses highlight the urgent need for solutions to safeguard access and strengthen care delivery in underserved areas. One such solution authorized by the OBBBA is the Rural Health Transformation (RHT) Program to invest in rural healthcare delivery.

Facing Closure: The Growing Crisis in Rural Healthcare

Rural facilities have faced an alarming rate of closures, with over 100 closing in the last decade. Southern states are at particularly high risk; in Alabama, 23 rural hospitals – half of the state’s total – are at immediate risk of closure. Rural hospitals carry high fixed costs, including 24/7 staffing, facility maintenance, and fully equipped departments, yet service smaller populations, generating less revenue to offset expenses than their urban hospital counterparts. Without sufficient federal support, these hospitals must negotiate with private insurers from a weaker position, often accepting lower reimbursement rates due to smaller patient volumes and limited market leverage.

Number of At-Risk Rural Hospitals Across the US

Number of At-Risk Rural Hospitals across the US based upon hospitals classified in the top 10% Medicaid payer mix of rural hospitals across the country and experiencing three years or more of negative total margin.

Source: Cecil G. Sheps Center for Health Services Research, University of North Carolina

Funding the Future of Rural Hospitals: Lifeline or Limited Relief

While the OBBB seeks to reduce overall federal Medicaid spending by $1 trillion over the next decade, it establishes the $50 billion Rural Health Transformation Fund – a five-year program to support rural healthcare and mitigate disproportionate impacts on rural hospitals. Analysts caution that this temporary lifeline is insufficient to offset massive financial losses from Medicaid cuts, straining hospitals (particularly those with high Medicaid populations), and limiting investment in care coordination and critical resources. However, broad discretion by the Centers for Medicare and Medicaid Services (CMS) and individual states in allocating funds raises concerns that resources may not reach hospitals most in need.

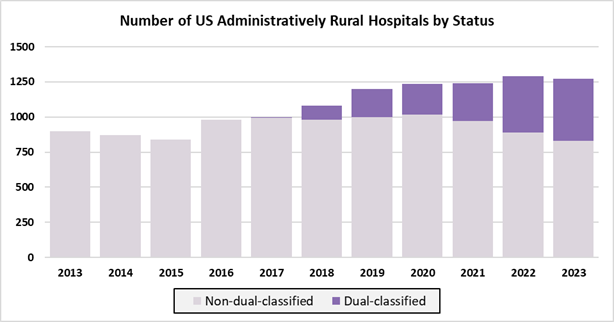

Johns Hopkins and Brown University research shows 400 urban hospitals now claim “rural” status; over a quarter are for-profit, and at least five generate more than $4 billion in annual net patient revenue. These are so-called dual-classified hospitals (those designated as both rural and urban) are uniquely positioned to take advantage of the new Health Transformation program, potentially diverting funds away from smaller hospitals facing genuine financial distress, as outlined in the graphic below.

Source: Wang et al., 2025; Sharp Rise in urban hospitals with rural status in Medicare, 2017-23. Raw data retrieved from RAND Hospital Data, Medicare Cost Reports. Note the number of geographically urban hospitals remains stable between 2013 and 2023 (2,543 – 2,258 respectively).

Medicaid Reform: Consequences for Patient and Providers

The OBBBA also introduces Medicaid work requirements, intended to encourage able-bodied adults to contribute to their healthcare coverage. While designed to promote employment and reduce reliance on public programs, evidence suggests these requirements often cause coverage loss due to administrative and technological challenges rather than unwillingness to work. For example, in Arkansas, over 18,000 people lost coverage within five months of a work requirement pilot, with little measurable increase in employment. Many beneficiaries already had jobs, caregiving responsibilities, or health limitations that made obtaining documentation difficult, and for rural communities, these requirements are especially burdensome. Eligibility checks every six months, technology demands, and verification for seasonal or self-employed work, such as farming, create challenges for both patients and county offices.

Rural hospitals are expected to be further negatively impacted by the new Medicaid work requirements. Coverage loss even among working populations could increase gaps in care and increase uncompensated care for rural hospitals. This decline in Medicaid coverage may reduce reimbursement streams, strain hospital finances, and heighten the risk of service cutbacks and closures, particularly in already vulnerable rural areas. In 40 Medicaid expansion states, federal funding cuts could lead to an average of 19% decline in operating margins, and safety-net facilities could see an average reduction of 56%. Together, these pressures underscore how Medicaid work requirements, while intended to encourage employment, may ultimately destabilize rural healthcare systems and weaken community access to essential medical services.

Looking Forward: Operational and Patient Impacts of the OBBBA on Rural Hospitals

- Operational Strain on Rural Hospitals: High fixed costs, limited patient volumes, and reliance on Medicaid make rural hospitals financially vulnerable to the new bill

- Coverage Loss and Access Gaps: Medicaid work requirements may cause individuals, even those employed, to lose coverage, increasing gaps in care and uncompensated services

- Funding Allocation Challenges: Broad discretion in Rural Health Transformation Fund and urban hospitals claiming rural status may divert resources away from truly at-risk facilities

- Impact on Care Coordination and Resources: Reduced funding and coverage instability can limit hospitals’ ability to invest in technology, supply chain efficiency, and coordinated care programs

- Patient & System Impacts: Loss of insurance and resulting delays or forgone care can lead to preventable negative health outcomes, increased emergency department use, and more intensive interventions, while ongoing financial and operational pressures may erode staff morale and weaken the stability of rural healthcare delivery

To navigate the evolving healthcare landscape, medical providers must take proactive steps to improve operational efficiency and financial stability. Hospitals are facing the challenge of doing more with less, as high pharmaceutical, labor, and administrative costs, coupled with looming Medicaid cuts, strain finances. In response, providers are adopting targeted strategies such as better controlling drug utilization, implementing new technologies, minimizing waste, and optimizing supply chain and procurement processes. With the urgency to reduce costs and operate more efficiently at an all-time high, these measures are critical for maintaining both quality of care and organizational resilience, while preparing for anticipated reimbursement reductions and declines in Medicaid enrollment.

Unlocking Savings and Resilience with Pathstone Partners

Pathstone offers rural hospitals cost-effective, hands-on support – bringing deep niche expertise, the agility to respond quickly to shifting challenges, and a partnership approach that tailors solutions to each hospital’s unique community and financial realities. Our boutique size and flexibility allow us to design customized strategies rather than using one-size-fits-all models, drawing on years of direct experience helping rural hospitals navigate financial pressures.

Reach out to Pathstone Partners today to request a no-cost spend assessment and understand how we can help drive financial efficiency for your organization.